Warren Buffett

Warren Buffett is considered one of the best investors in the world.By following the principles defined by Benjamin Graham, he built a personal fortune estimated at several billion dollars thanks to investment in equity and the purchase of companies through his investment company Berkshire Hathaway.Café de la Bourse gives you video a selection of the best advice from Warren Buffett to successfully invest in the stock market.

Discover the 7 most impactful tips of Warren Buffett on the investment in order to excel in the art of Stock Picking and to go master in stock market investment.

Also find our analysis of the Warren Buffett stock market portfolio in 2023 to find out its favorite companies and its stock market stocks.

For Warren Buffett, " The risk comes from not knowing what we are doing. »»

Invested only in companies you understand well.It seems to be obvious but many people wrongly think that they will let opportunities spin if they restrict their field of investment.

Yet Warren Buffett insists:

"" There are all kinds of companies that Charlie [Charlie Munger is the main business associate of Warren Buffett] and I do not understand, but we do not lose sleep.It only means that we are going to the next, and this is what the private investor should do. »»

"" Better to buy an extraordinary business at an ordinary price than an ordinary company at an extraordinary price. »»

Patience then!You don’t have a pistol on the temple.No hurry.Be patient and invest in high -quality companies when their prices become reasonable.You will take less risks while obtaining better results.

According to Warren Buffett, " Most people are interested in actions when everyone is interested.The moment of being interested is when no one else is.You cannot buy what is in sight and succeed. »»

The precepts of Omaha’s Oracle allow the FOMO to be avoided, this fear of missing an opportunity that pushes to invest in any asset or fashionable sector on the pretext that its course is flying away.Do not buy actions from a company after reading an electric article.Everyone will have the same idea!And above all beware of fashion effects, they created speculative bubbles!Do not fall into the current craze around artificial intelligence for example.Finally, do not take the recommendations of financial analysts to the letter which can be contradictory.

Make your own opinion and do not hesitate to go out of the beaten track of the values of the CAC 40: for example by diversifying your investments with ETFs which can be a good way to invest in the stock market.

However, it is possible to invest in fashionable companies and Warren Buffett has also bought Apple or Amazon shares, but there is no means to buy companies only because they are fashionable.You must base your stock picking on the fundamentals, valuation and understanding of the business model.

Warren Buffett says: " I invest in companies so wonderful that they can be managed by an idiot.Because sooner or later it will happen. »»

Invest in companies that are simple to understand and easy to manage.If the activity of a business is too complex, stay away.You will not be able to assess it.Favor companies that remain faithful to their basic activity such as Coca Cola for example.

Warren Buffett is categorical: " Do only what you would be perfectly happy to keep if the market closed for 10 years.»»

Avoid monitoring the day -to -day market news, you might find that stock prices do not evolve quickly enough.And the temptation to use the lever effect will be greater.However, if it allows you to multiply its earnings, it also multiplies losses!

Difficult not to think of real estate, favorite placement of the French when we hear this little sentence of Warren Buffett : "Our favorite investment horizon is forever.»»

Real estate is indeed a tangible asset, decorrelated from the financial markets which it is good to consider to diversify its assets in stock market investments!

Warren Buffett expresses this idea full of common sense in these terms: " If you ever find yourself in a flowing boat, the energy to change boat is more productive than energy to clog the holes. »»

In other words, don’t obstruct yourself, sell!

"" See market fluctuations as your ally rather than your enemy;take advantage of madness rather than take part in it.»»

Warren Buffett insists on the importance of a certain detachment and goes even further by encouraging to take the opposite of the trend: " We are just trying to be worried when others are eager and eager when others are worried.»»

In conclusion, we invite you to analyze your successes as your mistakes.According to Warren Buffett, " In the business world, the rear view mirror is always clearer than the windshield. »Take the opportunity to try to understand what you have succeeded and how, and where you failed and why!

Finally, do not forget the gold rule of Warren Buffet: " Rule number one: do not lose money;Rule number two, never forget the number one rule ".

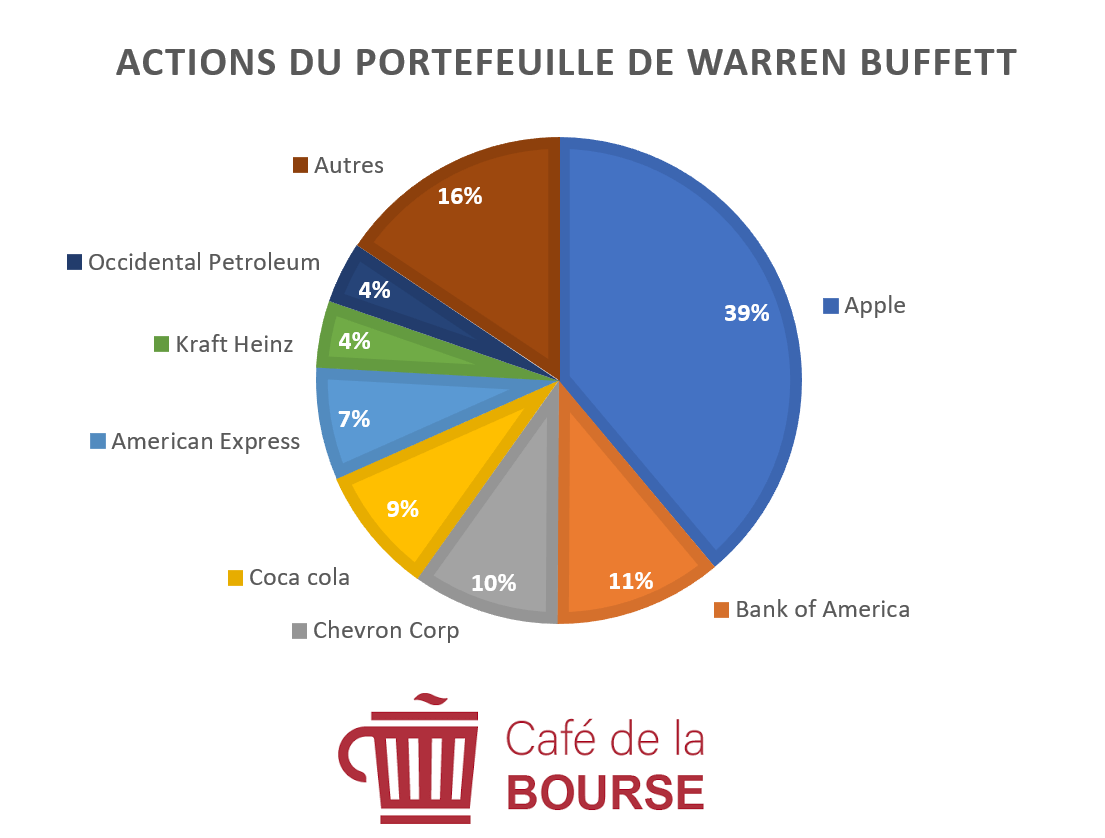

With a global value of $ 299 billion on December 31, 2022, discover our analysis and the composition of the Warren Buffett stock market in 2023!Note that this is actually the portfolio of the Warren Buffet fund, Berkshire Hathaway Inc. Note that Warren Buffet also has shares in JP Morgan and Wells Fargo for amounts that are not publicly known.

The company created by Steve Jobs represents 38.9 % of the Warren Buffet portfolio, Or a valuation of $ 116.3 billion on December 31, 2022.

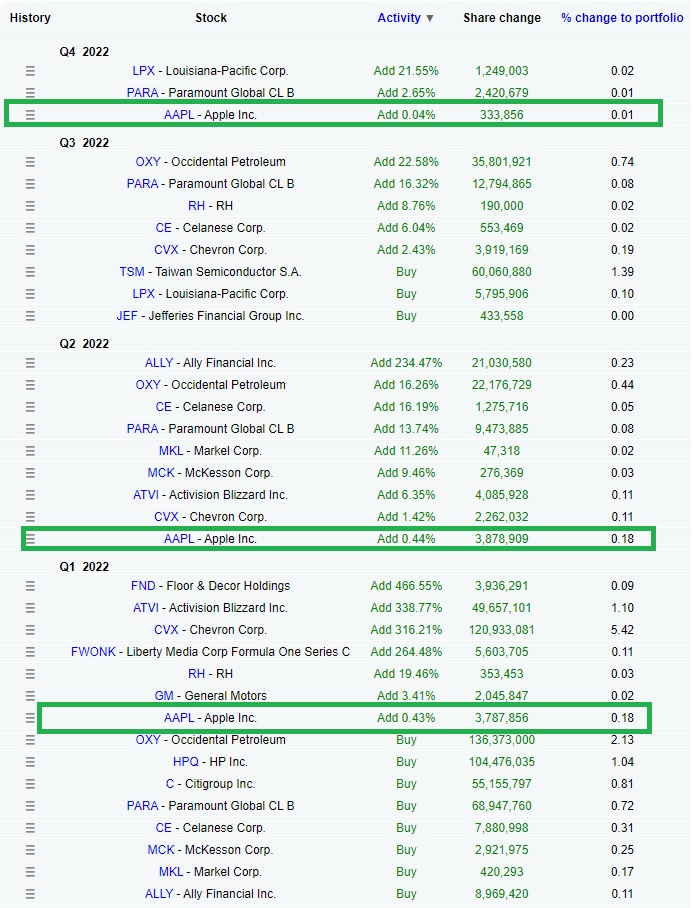

In 2022, Warren Buffet bought 7.98 million Apple shares, or 3.78 million Apple shares in Q1 2022, 3.87 million shares in Q2 2022 and 330,000 shares in Q4 2022.Decision which reflects a strong conviction, while Apple action has dropped sharply in 2022 (-30 %).

According to our detailed calculations below, the cost price of this position on the Apple action comes out at $ 27.27*, which represents an excellent investment because its valuation on March 27, 2023 is established at $ 143.44 billion($ 160.25 per share).

The added value is therefore substantial (Apple action price on March 27, 2023: $ 160.25 subtracted from the cost price of $ 27.27* gives a capital gain of $ 132.98 per share).Once multiplied by 895 136,175 actions held, the added value appears at $ 119,035,209,000 ($ 119.03 billion).

When we know that the BPA (benefits by action) of the Apple action oscillate between $ 2.99 and $ 3.31 in the last 3 years, the cost price of the Apple actions of Warren Buffet benefit from aExcellent per less than 9 (the PER measures the number of years of profits necessary to reach the price of an action).

*(variation in the number of Apple actions acquired and assigned between 1er quarter 2016 and 2ND Semester 2021 = 847 888 566;Total value of these purchasing and transfer operations: $ 23,117,781,253;Cost price calculated by the division between the total value of operations and the variation in the number of shares over the period: 23,117,781,253 $ / 847,888,566 = $ 27.27).

Bank of America shares represent 11.19 % of the Warren Buffet portfolio, Or a valuation of $ 33.45 billion on December 31, 2022.

The position of Warren Buffet within Bank of America was relatively low on the scale of his portfolio (less than 1 %) between 2007 and mid-2017.That is from 3th quarter 2017 that the famous investor decides to invest almost 10 % of his portfolio in stock bank of America, a position of 679 million shares acquired at $ 25.He then strengthened his position at 3th quarter 2018 for 200 million shares and thus achieve 877 million shares.

Following a new investment in the company at 3th quarter 2020, Warren Buffet holds on December 31, 2022 1.01 billion Bank of America shares for a value of $ 33.45 billion.

Chevron shares represent 9.78 % of the Warren Buffet portfolio, Or a valuation of $ 29.25 billion on December 31, 2022.

While Warren Buffet began investing in the oil group at the end of 2020, it was at the beginning of 2022 that he greatly increased his participation in the Chevron action with the purchase of more than 120 million sharesfor an amount of $ 19.44 billion.

Coca-Cola shares represent 8.51 % of the Warren Buffet portfolio, Or a valuation of $ 25.4 billion on December 31, 2022.

Often described as the "school case" example of the ultimate performance investment (dividend aristocrat), Coca-Cola action is one of the "furniture" of the Warren Buffet portfolio.It retains its 400 million Coca-Cola shares in a long-standing portfolio.

American Express shares represent 7.49 % of the Warren Buffet portfolio, Or a valuation of $ 22.4 billion on December 31, 2022.

It is clear a real conviction on American Express when Warren Buffet decides at 4th quarter 2006 to acquire 151.6 million shares at $ 60, then representing 17.43 % of its portfolio.Since then, its position has not moved in terms of number of actions, but the action rates almost triple on March 27, 2023 ($ 159.78).

Kraft Heinz shares represent 4.43 % of the Warren Buffet portfolio, Or a valuation of $ 13.25 billion on December 31, 2022.

Marginal position in the Ocaha Oracle portfolio until mid-2015, it’s 3th Three-year quarter that he decided to devote 18.03 % of his portfolio to Kraft Heinz shares, or 325.6 million shares at $ 70.Its position has remained intact since in terms of the number of shares held, but the stock market price is currently lower ($ 38.18 in March 27, 2023).

Western Petroleum shares represent more than 4.09 % of the Warren Buffet portfolio, Or a valuation of $ 12.24 billion on December 31, 2022.

While Warren Buffet had completely liquidated Western Petroleum shares in 2020, he bought almost 200 million shares from the oil group in 2022. A first purchase of 136 million action in early 2022 and two other purchases of 22 and 36 million respectivelyof action.

Moody’s shares represent 2.30 % of the Warren Buffet portfolio, Or a valuation of $ 6.8 billion on December 31, 2022.

We can admit that Warren Buffet had Flair when he decided to acquire 48 million Moody’s shares over 15 years ago!However, it reduced its position to 31 million shares at the end of 2009, and 25 million shares in mid-2013.He may have to regret it somewhat because the Moody’s course amounted to $ 362 per share on June 30, 2021 while Warren Buffett has lined twice 18 % of his position on $ 20/27 in 2009.

The other shares represent 13.31 % of the Omaha Oracle portfolio.

- Activision Blizzard Inc (1.35 %; $ 4 billion)

- HP INC (0.94 %; $ 2.8 billion)

- Davita Healthcare Partners (0.90 %; $ 2.69 billion)

- Verisign (0.88 %; $ 2.63 billion)

- Citigroup Inc. (0.83 %; $ 2.49 billion)

- Kroger (0.75 %; $ 2.22 billion)

- Visa (0.58 %; $ 1.72 billion)

- Liberty Media Corp.(0.57 %; $ 1.69 billion)

- General Motors (0.56 %; $ 1.68 billion)

- Overall paramount (0.53 %; $ 1.58 billion)

- Mastercard (0.46 %; $ 1.38 billion)

- Aon (0.44 %; $ 1.31 billion)

- Charter Communication Inc. (0.43 %; $ 1.29 billion)

- Bank of New York Melon (0.38 %; $ 1.14 billion)

- McKesson Corp.(0.36 %; $ 1.07 billion)

- Corp cessation (0.33 %; $ 992 million)

- Amazon (0.30 %; $ 895 million)

- Snowflake (0.29 %; $ 879 million)

- Liberty Siriusxm Series A (0.27 %; $ 794 million)

- Globe Life (0.26 %; $ 765 million)

- T-Mobile US (0.25 %; $ 733 million)

- Ally Financials Inc. (0.24 %; $ 728 million)

- Markel Corp.(0.21 %; $ 616 million)

- Restoration Hardware Holdings Inc. (0.21 %; $ 630 million)

- Taiwan Semiconductor SA (0.21 %; $ 617 million)

- Liberty Media Corp Formula One (0.15 %; $ 461 million)

- Nu Holding (0.15 %; $ 435 million)

- Louisana-Pacific Corp (0.14 %; $ 417 million)

- Floor & Decor Holdings (0.11 %; $ 332 million)

- US Bancorp (0.10 %; $ 290 million)

- Stoneco Ltd (0.03 %; $ 100 million)

- Johnson & Johnson (0.02 %; $ 57 million)

- Marsh & McLennan (0.02 %; $ 67 million)

- Procter & Gamble (0.02 %; $ 47 million)

- Liberty Latin America Com Cl A (0.01 %; $ 19 million)

- Mondelez International (0.01 %; $ 38 million)

- SPDR S&P 500 ETF Trust (0.01 %; $ 15 million)

- Vanguard S&P 500 ETF (0.01 %; $ 15 million)

- Jefferies Financial Group (0.01 %; $ 14 million)

- Liberty Latin America Com Cl C (0.009 %; $ 9 million)

- United Parcel Service Inc (0.01 %; $ 10 million)

Source: Dataroma

A strategy clearly stands out when studying the Warren Buffet portfolio: confidence in its long -term investments!

Indeed, we note that his big convictions of a few decades ago are often still in a portfolio, especially for his main positions such as Coca Cola, Bank of America, or American Express.These very large groups on which Warren Buffet rose to capital with interesting yields at the time of his purchases are still on the portfolio to date.

Needless to remember that Warren Buffet’s strategy is far from resembling that of trading.

It is therefore rather conviction and confidence in its investments that animate and fascinate Omaha’s famous Oracle multimillionaire.

Finally, we will note a very substantial position: 38 % of the Warren Buffet portfolio within the Apple group (but acquired for a very attractive cost price because of less than $ 30 in 2016).Some well calculated risk or a little lucky risk?

Who is Warren Buffett?

Also called Omaha’s Oracle, this engineering investor is a multimillionaire who has built his fortune alone by investing in the equity markets.He has been one of the richest men in the world for decades for decades.The Forbes ranking of 2021 gave it 6th world fortune.

How is Warren Buffett’s fortune made up?

The fortune of Warren Buffett is essentially made up of shares in his investment company Berkshire Hathaway.He notably invested in Coca-Cola actions, Bank of America, American Express, or Apple.

How to invest as Warren Buffett?

Faithful disciple of Benjamin Graham, Warren Buffett rather adopts a Value approach and a Buy & Hold strategy.He endeavors to invest in companies with solid fundamentals and attractive stock market valuation.He provides his advice during the annual general meeting of his investment company.His letter to shareholders is eagerly awaited each year by the financial markets.

All our information is, by nature, generic.They do not take into account your personal situation and do not in any way constitute personalized recommendations for the realization of transactions and cannot be assimilated to a service advice in financial investment, nor to any incentive to buy or sell instrumentsfinanciers.The reader is solely responsible for the use of the information provided, without any use against the company editor of cafedelabourse.com being possible.The responsibility of the company editor of Cafedelabourse.com cannot in any case be engaged in the event of an error, omission or inappropriate investment.