How long does it take to pay taxes?

For those who have filed a final tax return to regain the overpayed tax, I think it is a matter of when the refund will be transferred.

This is a summary of the general schedule, confirmation method, and precautions before the refund of the too much income tax is transferred.

It is common for a refund of too much income tax to be transferred one to a month after the final tax return.

The final tax return to make a tax return is stipulated from mid -February to mid -March every year, but if you want to receive a refund, do not wait for the final tax return.It is possible to declare.

>>> Know more about the refund mechanism for final tax returns

>>> Know more about the refund procedure in the final tax return

Since the tax office does not work on weekends and holidays and the year -end and New Year holidays (from December 29 to January 3), the date that can be filed for 2015 for the earliest for 2015 is January 4, 2016.Will be.Even if the same tax return period is the same tax return period, if you file an electronic declaration by E-Tax, the period to be refunded will be reduced to about three weeks later.

The following is a summary of the schedule until the refund is transferred.

・ Scheduled transfer date for refund declaration in early January: early February to mid -February

・ Scheduled transfer date for final tax return or refund tax return in mid -February (time to file tax return): mid -March to late March

・ Scheduled transfer date for a final tax return or refund tax return in mid -March (the end of the final tax return): mid -April to late April

・ Scheduled transfer date for refund declaration in early January: mid -January

・ Scheduled transfer date for final tax return or refund tax return in mid -February (time to tax return): early March to mid -March

・ Scheduled transfer date for final tax return or refund tax return in mid -March (end of final tax return): early April to mid -April

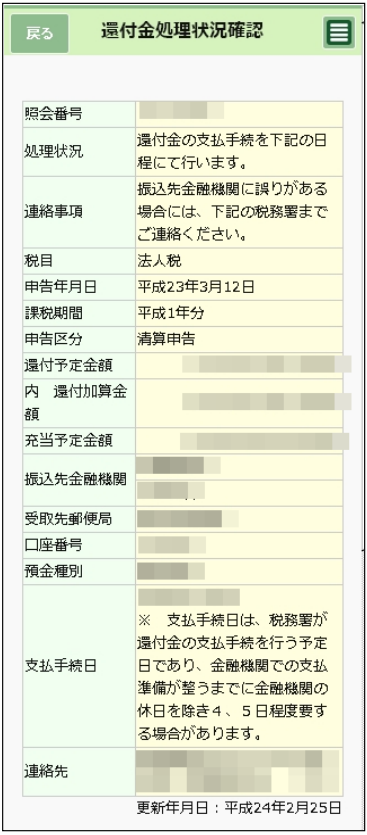

You can also check the refund processing status in real time by electronic declaration with e-tax.

If you file a tax return in writing, you will not be able to confirm it on the web, so you will have to contact the tax office directly.

(Source: How to use the reception system | E-Tax HP)

The schedule until the refund is transferred is as follows.

2. After the refund payment procedure is completed at the tax office, the scheduled amount of refund and the expected refund date will be confirmed.It may take 4-5 days to actually be deposited.

Furthermore, if you use the "E-Tax Soft (SP version)" app, you can check the processing status of refunds on smartphones and tablet devices.

E-TAX software (SP version) not only checks the processing status of the refund, but can also enter the payment amount to pay tax payment certificates.

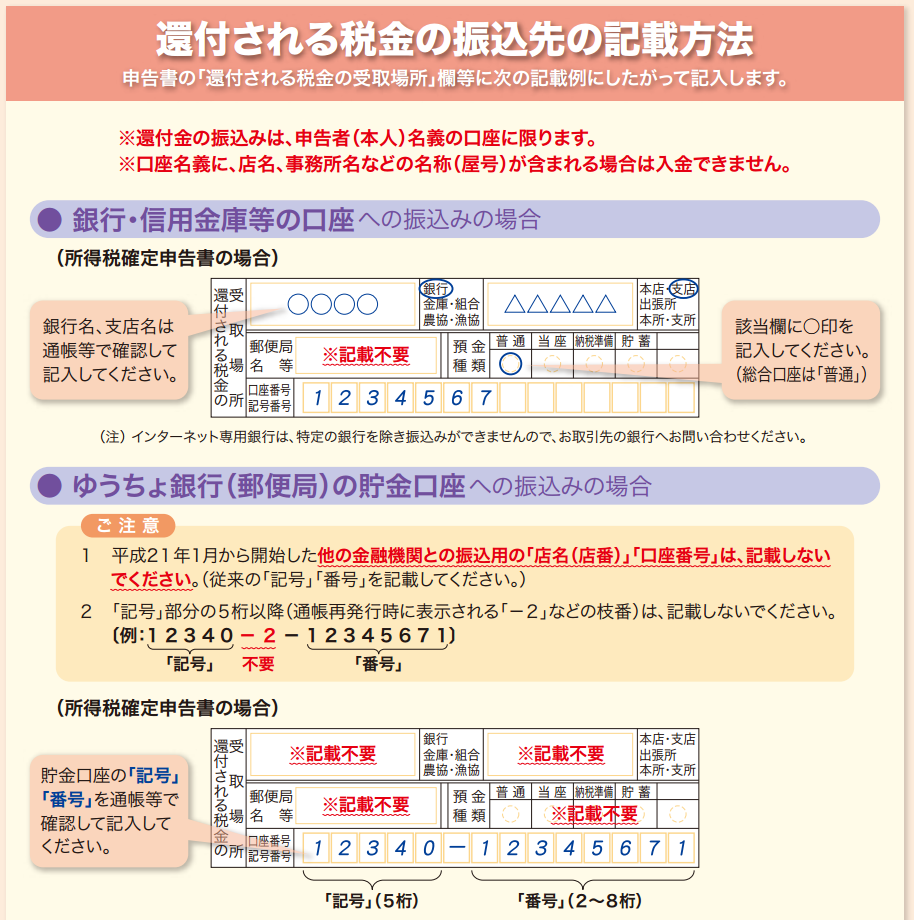

If you wish to transfer a refund to a financial institution account, the name of the transaction financial institution, branch name, deposit type, and account number in the "Return Tax Reception Place" column at the bottom right of Table 1 of the Declaration Form.I will write it.

(Source: How to transfer to a savings account PDF | National Tax Agency HP)

There are two points to note about receiving the refund by transfer.

The transfer account for receiving the refund is the declared account.

Therefore,

・ Spouse and family account

・ Account with the name of the building

・ Account that is still the maiden name

May cannot be transferred.

Internet bank that cannot receive a refundthere is.

If the Internet Bank cannot receive a refund, you will specify another financial institution.You can use banks, shinkin banks, credit unions, labor unions, agricultural cooperatives, fishery cooperatives, and Japan Post Bank.You can also choose a method of receiving it directly at Japan Post Bank or post office.

If you cannot transfer or open a new account due to these precautions, you will have to select a way to receive it directly at Japan Post Bank or post office.

In order to receive a refund at the Japan Post Bank or the post office window, fill in the "Tax Reception Location" column, fill in the store name of Japan Post Bank or Post Office, and file a final tax return.

After that, we will bring a brought national treasury remittance notice and identity verification document (driver’s license or passport) and receive a refund at the designated Japan Post Bank store or post office.

It is surprisingly unknown that "final tax return to regain too much taxes = refund tax return" from January.If you want to receive overpayed taxes as soon as possible, we recommend that you declare them as soon as possible.

In addition, since it can go back to the past five years, if you have forgotten to refund due to childbirth and retirement, you can file a refund if it is deadline.If you have forgotten the refund declaration, let’s check as soon as possible if you can file a refund.

If you are a first tax return, you are worried about bookkeeping knowledge, or if you want to create a tax return document efficiently, we recommend using the tax return software.

The "Money Forward Cloud Fixed Tell Tax Tell", which is a sole proprietary software for the owner, can automatically create the required tax return, and provides not only Windows and Macs but also dedicated apps.

① Automatically acquire the transaction statement

If you register a bank account or card, you will automatically get the transaction statement.Regarding cash payments, it is possible to enter the date and amount of money yourself with the image of a household account book.

Try it for free

② Automatic proposals for journal accounts

AI determines information such as automatically acquired transaction specification data and invoices and receipts uploaded after receipt, and automatically input journals.The more you learn, the more accuracy you can, and the more efficient your daily slip input will be made.

See details of the function

③ Automatic creation function of tax return documents

It corresponds to both white and blue declarations, and can automatically create the documents required for the final tax return.In addition, you can submit directly from your smartphone with the Money Forward Cloud final tax return application.It also supports printing and submission with e-Tax software.

What is the schedule from the final tax return and the refund is transferred?

It is common for a refund of too much income tax to be transferred one to a month after the final tax return.Please check this out for details.

What is the transfer account to receive the refund?

It is an account of the decline.You may not be able to transfer your spouse or family, accounts with your name, or accounts with your maiden name.Please check this out for details.

Which banks cannot receive a refund?

Internet banks may not be able to receive a refund.Please check this out for details.