How long does it take to divide?

If your family dies and your inheritance occurs, you will need to do an inheritance procedure at the bank and refund the deposits of the deceased.

Please note that if the necessary documents are inadequate, resubmit and correction will be required, and the period to complete the procedure will be longer.

In order to finish the procedure smoothly, it is not only necessary to eliminate the deficiencies of the documents, but it is a good idea to start collecting necessary documents from the time of inheritance.

Also, if you are working during the day of weekdays and it is difficult to collect procedures and necessary documents at banks or government offices, we recommend that you ask a judicial scrivener or lawyer who is familiar with inheritance.

In this article,I will explain.

If your family or relatives die, you need a bank inheritance procedure.

When performing an inheritance procedure for banks, it is necessary to collect the necessary documents and confirm the bank side.

Specifically, it is necessary to perform the following procedures until the bank confirms the death of the account holder and refunds the heir.

(It often takes more than a month to collect family register for deceased and heirs)

Also,

If you want to shorten the time to refund your deposits and deposits, understand the flow of the inheritance procedure and collect necessary documents efficiently.

In the next chapter, I will explain in detail the flow of the procedure when refunding the deposits of the deceased.

In order to refund your deposit and savings from the deceased’s bank account, you must decide who will inherit the deposits and savings and submit the necessary documents to the bank.

Specifically, let’s proceed with the following flow.

The above procedure is also required for inheritance procedures other than savings and savings.

If you want to know the whole flow of the inheritance procedure, please refer to the following article.

Therefore, first check if the deceased had prepared a will.

If the deceased has created a will, it is highly likely that it will be found in the above method.

There are three main types of wills, and those that were prepared by the deceased.

The claims for the detection procedure and the required documents are as follows.

- Steabers of the will

- The heir who found a will

- Revenue stamp 800 yen

- Postage stamps for contact

- Inspection of wills for the will

- Will

- A copy of the family register that understands inheritance (removal, renovated original family register, etc.)

If the deceased did not prepare a will,

This is because all heirs must participate in the heritage division consultation that discusses who will inherit which property.

The heir survey is

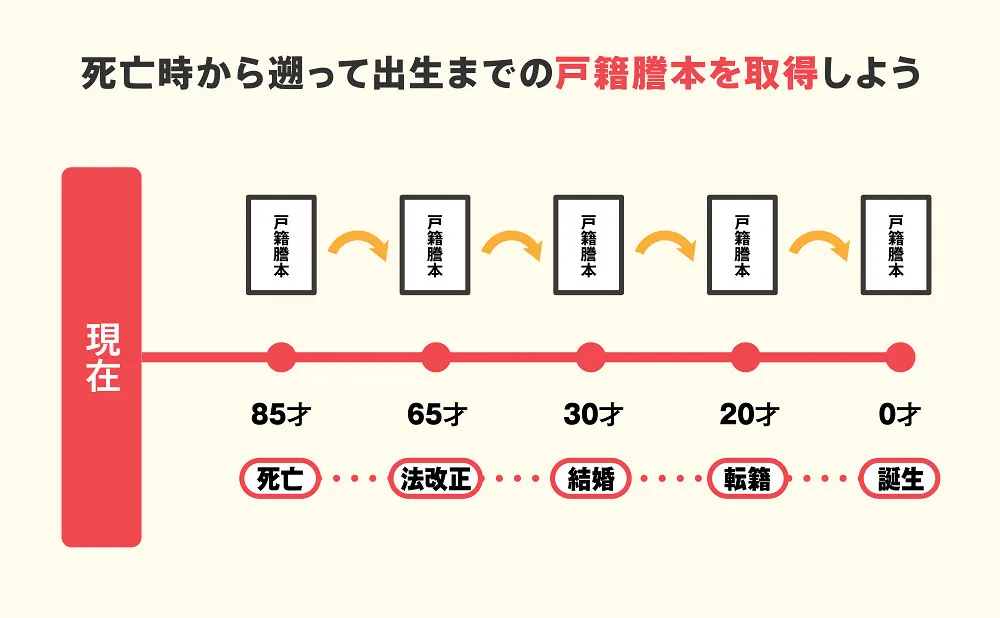

The copy of the family register has the previous home address, so if you go back from the time of death, you can collect it without interruption.

Once the deceased’s family register has been collected, the family register of all heirs will also collect.

Please refer to the following article for the method of the heir survey.

If the deceased did not prepare your property catalog before your life, you can identify the bank you used in the following way.

In that case, you must identify the financial institution you used before checking the deceased’s smartphone and personal computer.

As long as you know the bank you used, you can issue a balance certificate and inheritance procedure, so there is no problem if you can not identify the account number.

Once the heirs and their inheritance are finalized, all the heirs will have a heritage division consultation.

What is a heritage division consultation?

When the heritage division consultation is completed, the contents are compiled in the heritage division consultation, and all the heirs are signed and sealed.

Contact the following window of the bank used by the deceased to refund the bank account for the deceased.

Depending on the bank, the inheritance procedure may be accepted on the web from the official website, so it is recommended to check first.

If you offer an inheritance procedure to the bank, the bank will send a document to the heir to the heir.

When the guidance arrives, collect and create the listed documents.

Although it may differ depending on the bank, it is often necessary to prepare the following documents at the time of procedure.

- Will

- A copy of the family register that allows you to confirm the fact of the deceased’s death

- A seal certificate of a person who inherits deposits (a will executor if there is a will executor)

- A letter of judging of the will executor (if there is a will executor)

- Certified record or certificate certificate (not required to complete the procedure with a notarized will)

- Passbooks, cash cards, certificates, etc.

- A copy of the deceased, a copy of the family register, etc. (what is connected from birth to death)

- A copy of the family register of all the heirs

- A seal certificate of all heirs

- Heritage division consultation (in the event of a heritage division consultation)

- Passbooks, cash cards, certificates, etc.

Once you have collected the required documents, submit them with the inheritance procedure prescribed by each bank.

There are two types of patterns above, so it is smooth to check in advance.

After submitting the required documents, the bank will check the contents, and if there is no defect, the deposits and deposits will be refunded to the heirs and the recipient.

As a result of the bank confirmation, if the content is incomplete, you will be required to resubmit or correct documents.

The correction seal needs to be pressed with a real seal, so

If you want to finish the refund procedure for the deceased’s bank account as soon as possible, it is important not only to collect the necessary documents efficiently but also to eliminate the film deficiencies.

If you want to finish the procedure smoothly or if you work on weekdays and do not proceed with the inheritance procedure, consider consulting a judicial scrivener or lawyer who is familiar with inheritance.

The bank inheritance procedure takes about 2 weeks to one month by collecting necessary documents and confirming the bank side.

If you want to use the deceased’s savings and deposits as a family expense of the family and the inheritance tax payment, many people will want to finish the bank as soon as possible.

If you want to shorten the period for the bank inheritance procedure, try the following methods:

I will explain in detail each.

When contacting the bank of the death of the account holder and offering an inheritance procedure,

In addition, if you submit the required documents to the bank counter, you will be able to confirm that there are any deficiencies in the documents.

The bank’s inheritance procedure is not only a branch that the deceased had opened an account.

In addition, if you make a reservation in advance when processing at the window, you can shorten the waiting time.

It depends on whether the deceased has prepared a will, but it is difficult to collect multiple documents required for bank inheritance procedures.

In addition, there are documents that are required for inheritance procedures other than banks, such as a copy of the deceased, a copy of the family register from birth to death.

Therefore,

Also,

If the bank checks the documents, if there are any questions or deficiencies, it will be necessary to resubmit and correct, and the inheritance procedure will take more time.

If you work on weekdays and do not have time to do the inheritance procedure on your own, or if you want to complete the inheritance procedure without mistakes, you may want to ask a judicial scrivener or lawyer who is familiar with inheritance.。

As described in Chapter 2 in this article, a will or a heritage division consultation is required to refund the deceased’s bank account.

However, depending on the situation at the time of inheritance, you may need to pay for funeral expenses, hospitalization expenses, and immediately living expenses, and you may want to withdraw the deposits of the deceased before the heritage division consultation is completed.

There are two types of refund system, whether to pass through the family court and not pass through, and each feature is as follows.

As described above, if it is up to 1.5 million yen, there is a possibility that the family court can withdraw savings without procedures.

If you need a coordinated cash for payment of funeral expenses, it is also recommended to use the refund system.

When performing an inheritance procedure at the bank, it is necessary to be careful not to identify the bank account used by the deceased without omission, or if you are considering abandonment of the inheritance, do not work at all.

Specifically, be careful of the following three points.

I will explain in detail each.

If the deceased is using an internet bank, it is difficult to find it unlike an account such as a megabank or a regional bank.

Internet banks often do not receive mail, and may not have a paper deposit passbook, so

If the deceased may have used the Internet Bank, let’s identify the bank you used by confirming the following:

If you can’t find the internet bank account used by the deceased, you will not be able to refund your savings, but there are also risks below.

Be sure to complete the inherited property before the creation of a heritage division consultation or inheritance tax filing.

In this way, if the deceased does not create a property inventory or will, the hassle of the family will increase the effort.

To reduce the burden on family and relatives

Please note that if heirs use the deposits and savings of the deceased, they may be considered to have inherited the property and cannot abandon the inheritance.

What is the inheritance abandonment?

For example, if the deceased has left a large amount of debt and cannot be repaid even if you use all the heritage, the heir will be obliged to repay unless you give up the inheritance.

If you give up your inheritance, you don’t have to return the debt of the deceased,

If you pay the funeral expenses of the deceased from deposits and deposits, it will not be considered a simple approval, but if you use savings for the hospital expenses of the deceased or the living expenses of the family, it will be a simple approval.

Specialized knowledge is required for handling property disposal when inheritance abandonment.

It is recommended to consult a judicial scrivener or lawyer who is familiar with inheritance when you consider the inheritance abandonment.

If the deceased’s bank account is frozen or after frozen, keep the deposits of the deceased using the temporary refund system, keep the receipt.

Even if the refunded deposits and savings are used to pay the funeral expenses and the deceased’s hospitalization expenses

It is safe to keep a receipt to avoid trouble, as other heirs may be suspected of using deposits and savings.

Also, keep the withdrawal of deposits and savings to the minimum and complete the inheritance procedure as soon as possible.

Bank inheritance procedures often take about 2 weeks to one month due to collecting necessary documents and confirming the bank side.

However, it is necessary to investigate the heirs and identify the banks used by the deceased before contacting the bank for inheritance procedures, so it may take more time.

If you want to smoothly complete the inheritance procedure, not just the refund procedure for the deceased, you should ask a judicial scrivener or lawyer who is familiar with inheritance.

If you are a judicial scrivener or lawyer, you can collect the required documents to refund procedures at once.

Green Judicial Scrivener Corporation receives consultations on inheritance procedures.

The first consultation is free and you can consult online, so please feel free to contact us first.